Sign Documents with Qualified eSignatures. Globally.

Legally binding documents throughout EU, and beyond. Secure and easy-to-use document signing proccess. Give Mark Sign a try and Sign up Now.

Companies trust us

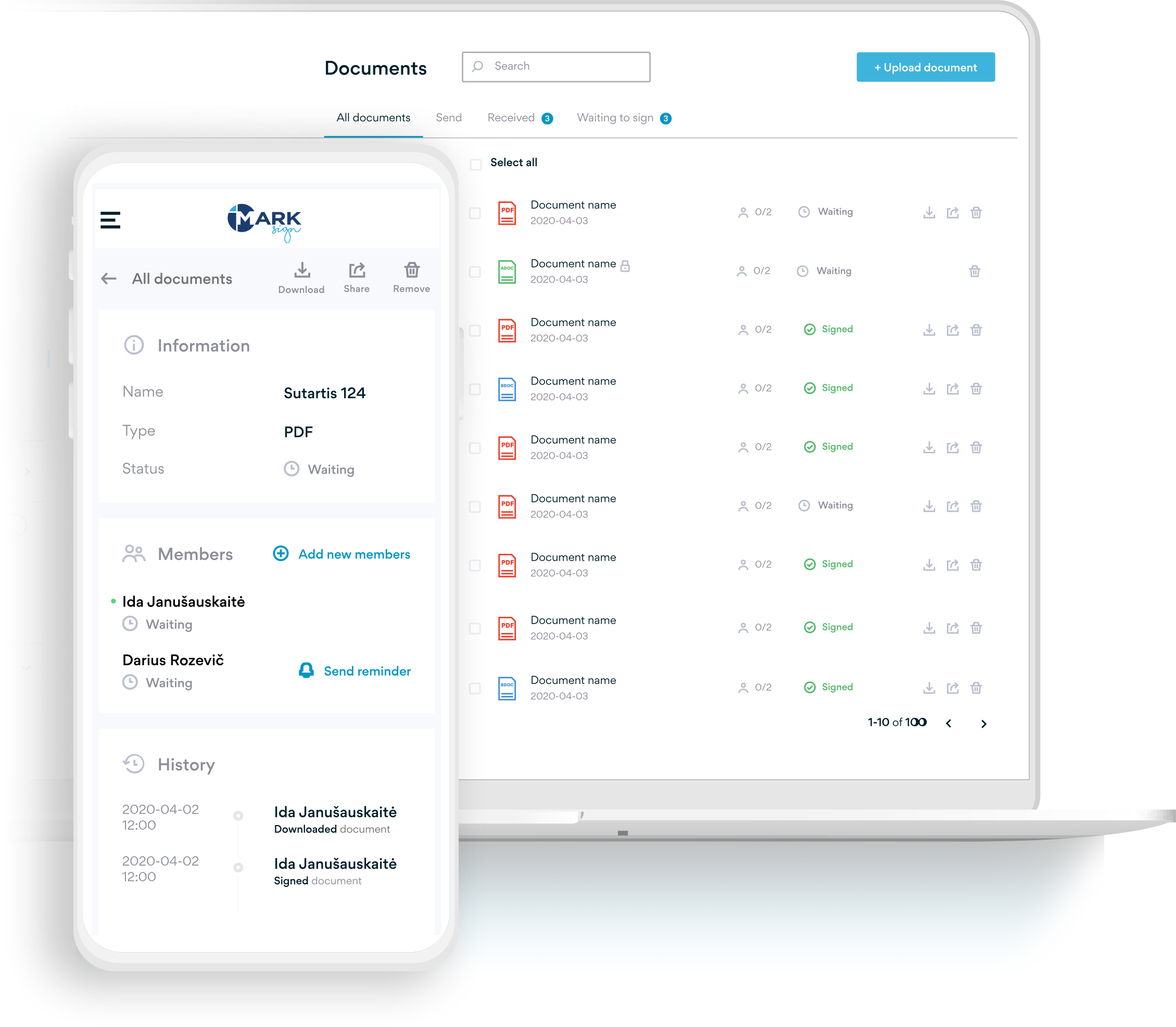

Sign, Manage and Validate signed documents with Ease

Global signing, Single account for teams, and more

Mark Sign features

Many ways to verify your identity

Sign documents from anywhere in the world using your Smart-ID, Mobile-ID, ZealiD, USB Token or Smart Card.

Legally binding signatures

After implementing advanced tools and following the strict requirements of the EU eIDAS regulation, we have created a solution where signed documents are equivalent to handwritten ones.

White-label solution

Send eSigning emails and reminders following your brand colors and logo.

Compliant to the highest standards

The continuous service availability and the highest security standards are fundamental to everything we do at Mark Sign.

We are certified by the globally recognized ISO 27001 information security management certificate, and our data regularly monitored by data security specialists.

Learn more about what we use to ensure seamless and reliable services.